If you have a standard cash or margin account, or options investor account, you’ll need to meet the $1 minimum. When cashing out on robinhood, you’ll need to meet the minimum requirements on your account.

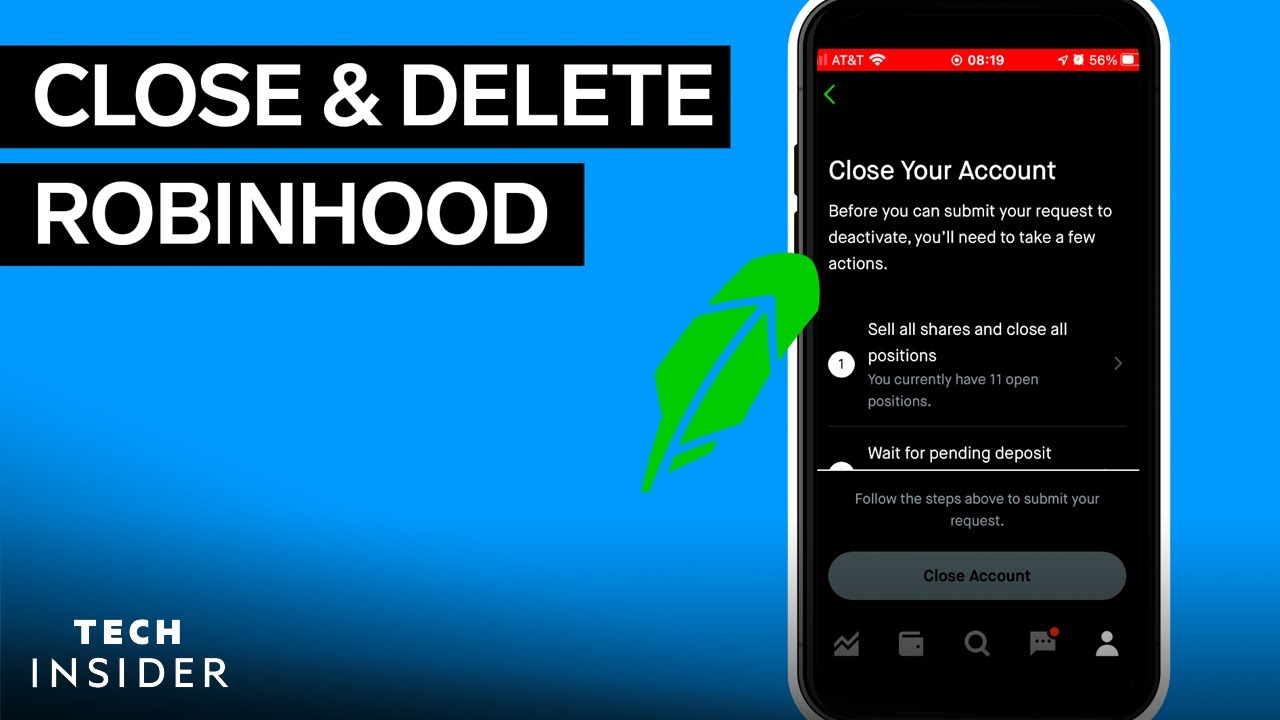

How To Close And Delete A Robinhood Account

Let’s make it clear upfront:

How much does it cost to close a robinhood account. It is a 100% free platform. If you use robinhood, you won't pay annual fees, commission fees, inactivity fees, and fees for moving money to your bank account. With robinhood instant and robinhood gold accounts, users are generally “limited to no more than three day trades in a five trading day period, unless you.

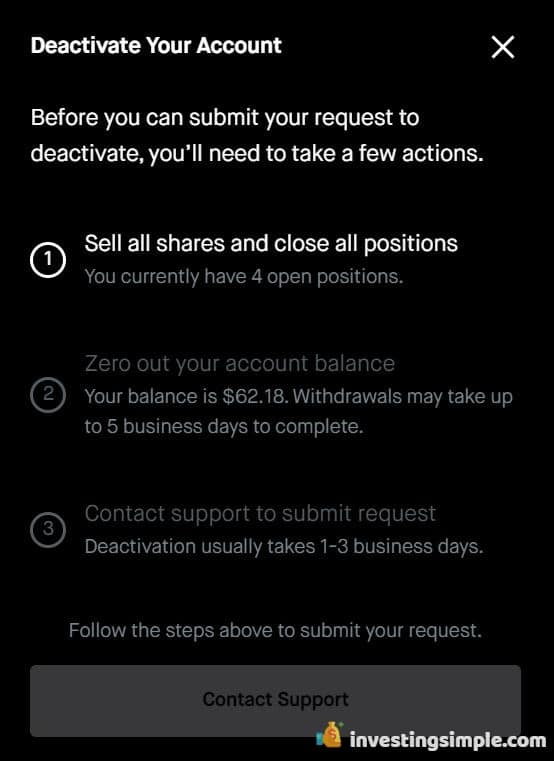

It’s trading on borrowed money. Whether you choose to close or deactivate your account, your robinhood account balance has to be $0. The firm doesn't offer individual retirement accounts at this time, so there are no ira fees to speak of.

Worse yet, this $75 fee is above average by industry standards. $20.70 per $1,000,000 of principal (rounded up to the nearest penny). $.000119 per share (rounded up to the nearest penny and up to $5.95).

Secondly, robinhood currently doesn’t allow leverage. They also needed to invest a minimum of $500 to open an account. Doing so will incur a $75 charge by robinhood, who apparently has to make money somehow.

Buying power and instant deposits of $1,000 costs $6 while instant deposits of $1,500 cost $9 for 30 days. Robinhood is a popular choice for beginning stock market investors, but at some point, you may. Deposits and withdrawals via the ach system are free of charge.

This means you have to either sell all of your positions and withdraw the balance to your bank account, or you have to transfer all of your assets from robinhood to. There is a $75 fee for partial and full acats out of robinhood. Cost to develop a trading app like robinhood.

They will often reimburse any transfer fees. The premium account offers a bigger instant. There is also no fee to close an account.

In 2016 i took a $1k trading account, and aggressively using leverage, i grew that account to over $8,600.00 in less than 1 month. Before robinhood, anyone who wanted to invest in stocks would be charged between $5 to $10 a trade. Alternatively, if you do need to use acats for some reason, talk to the broker you are making the acats transfer to.

Few of them are the location where the app belongs to,. For starters, ally invest only charges you $50 to transfer out your account, while td. Don’t use acats, use ach.

For example, investors pay a monthly fee of $5 for a robinhood gold account, which offers research reports to help investors make better decisions. Robinhood is a popular choice for beginning stock market investors, but at some point, you may. Some account fees you may encounter are:

Transferring your robinhood account to another broker will cost you money. Cryptocurrency held with robinhood crypto is not currently transferable to other brokerages. So it doesn’t make any sense.

Before we begin, it’s important to note that there are fees involved when withdrawing your money from robinhood. Coming to the costing aspect of developing an app like robinhood, it is bounded to so many factors. The app needs to facilitate these kind integrations for the users to trade.

For more on instant deposits, our robinhood instant deposit restricted piece will outline how to. 1 the margin interest rate charged by robinhood financial is 2.5% as of december 21, 2020. That means if you only trade stocks, and don't trade that often, chances are robinhood is earning less than $137 from your account — but more than that from someone else's.

Robinhood does not charge anything to close a brokerage account. If you transfer a brokerage account into robinhood, the broker charges nothing (although the other firm may charge). After you complete a full acat transfer, we’ll close your robinhood account.

Unlike other crypto platforms, there is no such thing as robinhood crypto fees. Even so, you should pay close attention. While transferring your trading account to robinhood costs nothing, you will need to pay $75 to go in the other direction.

The app should also have the facilities where a user has to transfer the funds from his trading account to banks as well. A $75 fee for a complete transfer to a new brokerage is pretty typ. But you'll pay a $5 monthly fee to.

There is a $75 account transfer fee when moving a securities account to another firm. Trading on leverage is a controversial topic. The rate might change at any time and at robinhood financial’s discretion.

Close Your Robinhood Account - Youtube

Close Your Robinhood Account - Youtube

How To Close And Delete A Robinhood Account

How To Close And Delete A Robinhood Account

Just Opened A Robinhood Account 3 Things You Should Know The Motley Fool

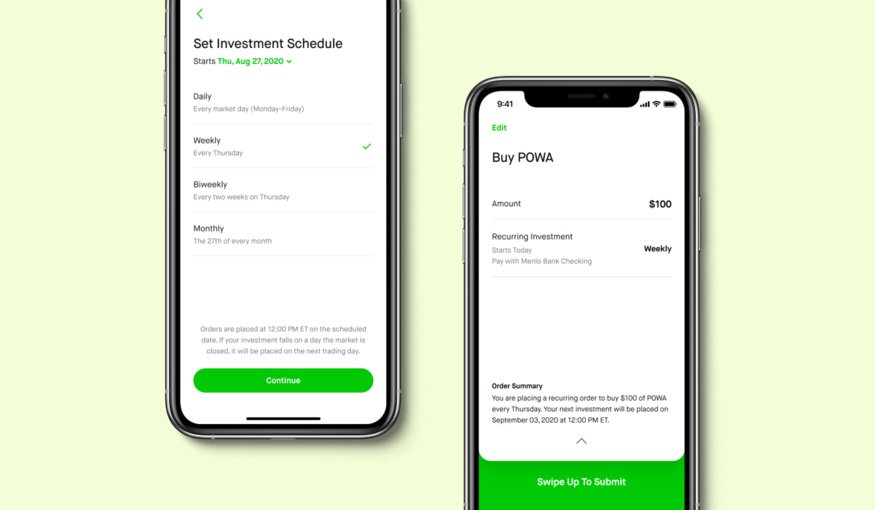

Options Stop Limit Orders Are Here Under The Hood

How To Delete Your Robinhood Account

How To Close And Delete A Robinhood Account

How To Close Robinhood Account 2021

How To Close And Delete A Robinhood Account

How To Close Your Robinhood Account Step By Step

Robinhood App How It Works And Everything You Need To Know Toms Guide

How To Close Your Robinhood Account And Switch To A New Trading App

How To Close And Delete A Robinhood Account

How To Close Robinhood Account In 24 Hrs - 6ya Instant Expert Help

How To Close And Delete A Robinhood Account

How To Close Your Robinhood Account Step By Step

Robinhood Ipo Heres What You Need To Know Forbes Advisor

Join Me In Deactivating Your Robinhood Account And Deleting The App Rpennystocks